Buying Property in the Algarve in 2025: Expert Tips and Steps

Complete Guide to Buying Property in the Algarve: Expert Tips and Steps for 2025

The Algarve region in Portugal is a dream destination for property buyers, offering stunning beaches, a warm climate, and a high quality of life. Whether you’re looking for a holiday home, a permanent residence, or an investment property, this guide will walk you through everything you need to know about buying property in the Algarve.

Table of Contents

- Why Buy Property in the Algarve?

- Top Locations in the Algarve to Buy Property

- The Algarve Property Market: Insights

- Step-by-Step Guide to Buying Property in the Algarve

- Legal Requirements and Documentation

- Costs and Fees Associated with Buying Property

- Tips for a Successful Property Purchase

- FAQs About Buying Property in the Algarve

- Conclusion

- Resources

Why Buy Property in the Algarve?

The Algarve, a coastal paradise in southern Portugal, is renowned for its spectacular beaches, friendly locals, and vibrant expat community. Here are the key reasons why buying property here is a great idea:

- Year-Round Sunshine: Over 300 days of sunshine annually make the Algarve attractive for outdoor enthusiasts and sun-seekers.

- Lifestyle and Amenities: The region boasts world-class golf courses, delicious cuisine, and a slower pace of life that appeals to retirees and families alike.

- Accessibility: Faro International Airport connects the Algarve to major European cities, making it a convenient getaway.

- Investment Potential: The Algarve offers strong rental yields and a growing luxury property market, ensuring excellent returns for investors.

- Safety and Healthcare: Portugal is one of the safest countries in Europe and provides top-notch healthcare services.

Which are the Top Locations in the Algarve to Buy Property

1. Lagos

A charming, town known for its maritime history, stunning cliffs, and vibrant nightlife. Perfect for those seeking a mix of modern amenities and natural beauty.

2. Tavira

This picturesque town offers traditional Portuguese architecture and a peaceful atmosphere. Tavira is ideal for retirees and those looking for a quieter lifestyle.

3. Albufeira

Famous for its lively atmosphere, sandy beaches, and vibrant nightlife, Albufeira is a favourite among holiday home buyers and investors.

4. Faro

The Algarve’s capital is a cultural hub with historical landmarks and excellent infrastructure. Faro is popular with expats and those seeking urban conveniences.

5. Vilamoura

Known for its luxury marina, upscale properties, and world-class golf courses, Vilamoura is a hotspot for high-end buyers.

The Algarve Property Market: Insights

The Algarve property market offers a wide range of options, from modern apartments to luxurious villas. Here are some key insights:

- Rental Yields: Average rental yields in the Algarve are approximately 5.6%, making it an excellent location for investors.

- Diverse Options: Property types include beachfront villas, countryside estates, and urban apartments.

- Average Prices: Prices vary by location, with upscale areas like Vilamoura and Lagos commanding higher prices. Average property prices range from €3,500 to €4,500 per square meter.

- Growing Demand: The region’s popularity among expats and tourists ensures a steady demand for properties.

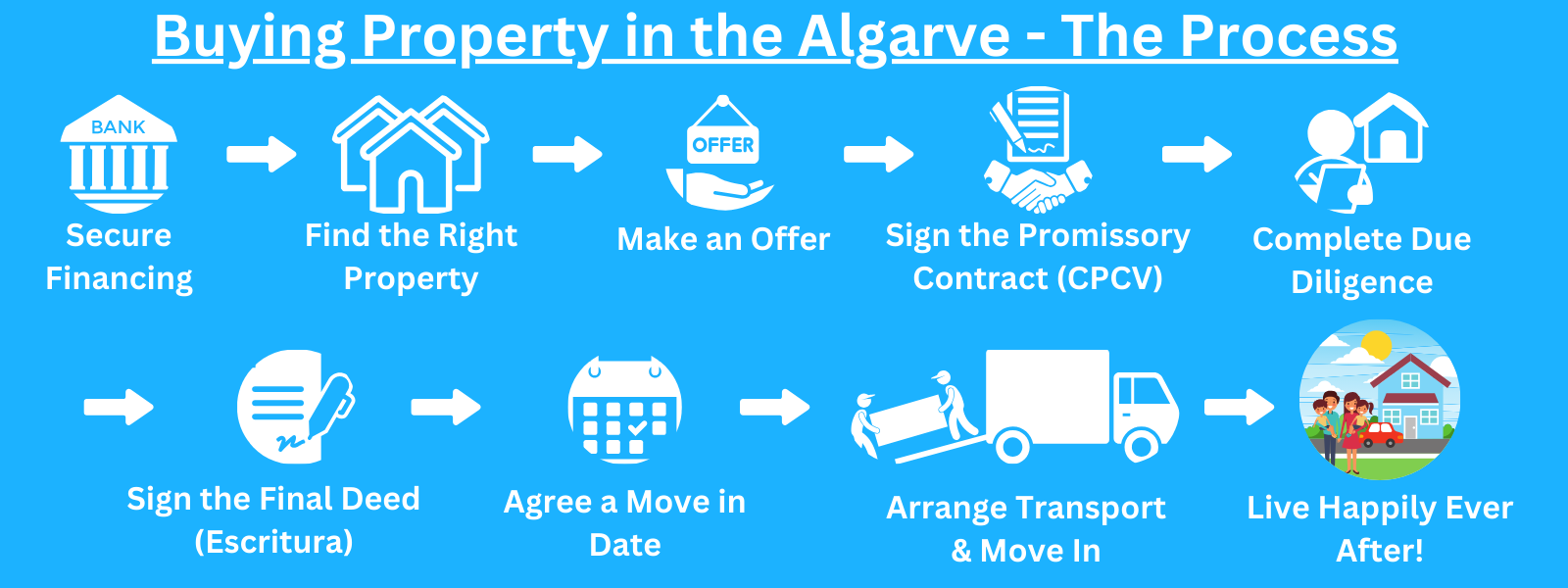

Step-by-Step Guide to Buying Property in the Algarve

1. Secure Financing

- Assess your budget and explore mortgage options. Non-residents typically need a 30% deposit.

2. Find the Right Property

- Work with a reputable real estate agent to explore options based on your preferences and budget.

3. Make an Offer

- Negotiate the price and terms with the seller. Having a buyer’s agent can help you get the best deal.

4. Sign the Promissory Contract (CPCV)

- This legally binding contract includes the agreed price and terms. A 10% deposit is typically required.

5. Complete Due Diligence

- Your lawyer will check the property’s legal status, ensuring there are no debts or encumbrances.

6. Sign the Final Deed (Escritura)

- Finalize the transaction at a notary’s office. This involves paying the remaining balance and taxes.

Legal Requirements and Documentation

To ensure a smooth property purchase, you’ll need the following:

- Fiscal Number (NIF): Required for property transactions and utility payments.

- Portuguese Bank Account: Essential for paying taxes and fees.

- Promissory Contract (CPCV): Details the terms of the purchase.

- Energy Certificate: Confirms the property’s energy efficiency.

- Final Deed (Escritura): Officially transfers ownership.

Costs and Fees Associated with Buying Property

1. Property Taxes

- IMT (Property Transfer Tax): Ranges from 0% to 8%, depending on the property price and type.

- Stamp Duty: Charged at 0.8% of the property value.

- Municipal Property Tax (IMI): Annual tax ranging from 0.3% to 0.45%.

2. Legal and Notary Fees

- Lawyer Fees: Typically 1% to 1.5% of the property value.

- Notary Fees: Approximately €300.

3. Additional Costs

- Survey Fees: Recommended for older properties.

- Utilities: Budget for connection and ongoing costs.

Based on the 2025 State Budget updates, the brackets for determining the Real Estate Transfer Tax (IMT) rates for residential urban properties in Portugal have been adjusted by 2.3%.

For properties intended exclusively for permanent residence, the updated IMT rates are as follows:

| Purchase Price (€) | Marginal Rate (%) | Deduction (€) |

|---|---|---|

| Up to €104,261 | 0 | 0 |

| €104,261 – €139,412 | 2 | €2,085.22 |

| €139,412 – €190,086 | 5 | €6,000.96 |

| €190,086 – €316,772 | 7 | €9,295.22 |

| €316,772 – €633,453 | 8 | €12,198.13 |

| €633,453 – €1,102,920 | 6 (single rate) | 0 |

| Over €1,102,920 | 7.5 (single rate) | 0 |

For properties intended for non-permanent residence, the updated IMT rates are as follows:

| Purchase Price (€) | Marginal Rate (%) | Deduction (€) |

|---|---|---|

| Up to €101,917 | 1 | 0 |

| €101,917 – €139,412 | 2 | €2,038.34 |

| €139,412 – €190,086 | 5 | €6,220.70 |

| €190,086 – €316,772 | 7 | €10,022.42 |

| €316,772 – €633,453 | 8 | €13,190.14 |

| €633,453 – €1,102,920 | 6 (single rate) | 0 |

| Over €1,102,920 | 7.5 (single rate) | 0 |

Example Calculation:

For a non-resident purchasing a property for €250,000:

- Calculate the IMT:

- €250,000 falls within the €190,086 – €316,772 bracket, which has a 7% marginal rate and a deduction of €10,022.42.

- IMT = (€250,000 × 7%) – €10,022.42

- IMT = €17,500 – €10,022.42

- IMT Payable = €7,477.58

These adjustments reflect the latest figures for property transactions in the Algarve and across Portugal.

For a comprehensive understanding of the IMT rates and other tax matters, you can refer to PwC Portugal’s 2025 State Budget analysis. PwC Portugal Latest state budget – October 11, 2024

Sources

Tips for a Successful Property Purchase

- Hire a Local Lawyer: Their expertise ensures legal compliance and smooth transactions.

- Work with a Buyer’s Agent: They represent your interests and can negotiate better terms.

- Conduct Due Diligence: Verify the property’s legal status and ensure there are no debts.

- Plan for Extra Costs: Budget 5% to 8% of the property price for taxes and fees.

- Understand Local Market Trends: Research property values and rental potential in your desired area.

Final Notes & Conclusion

By following this guide and seeking professional assistance, you can easily and confidently navigate the property-buying process in the Algarve. With its stunning landscapes and vibrant culture, owning property in the Algarve is an investment in a dream lifestyle.

If you are looking to purchase your dream home in the Algarve in 2025, contact us here at Gatehouse International Mediação Imobiliária Lda for a professional service from a real estate agent with over 20 years of experience in the Algarve property market.

Useful Resources

- Portal das Finanças: The official website of Portugal’s Tax and Customs Authority offers comprehensive information on the Portuguese tax system, including property taxes.

- Gov.pt: This government portal provides detailed guidance on paying the Municipal Property Tax (IMI) in Portugal, outlining rates, exemptions, and payment procedures.

- Global Property Guide: Offers an analysis of Portugal’s residential property market, including recent trends and statistics, which can provide context to your readers about the current real estate landscape.

- Portugal Buyers Agent: Provides a detailed guide on property taxes in Portugal for 2024, covering IMI, IMT, stamp duty, and capital gains tax, which can help readers understand the financial aspects of purchasing property.

- The Portugal News: An article discussing the popularity of different municipalities in the Algarve among property buyers, offering insights into regional demand and market dynamics.

- Algarve Daily News: Reports on property market trends in the Algarve, highlighting areas with significant value increases and providing forecasts for future growth.

- The Portugal News: An analysis of luxury real estate developments in the Algarve, comparing property values and growth across different regions.

Mark McLoughlin: A Passionate Explorer of Algarve’s Rich Heritage

For over 20 years, Mark has called the Algarve home, immersing himself in its landscapes, culture, and history. His passion lies in sharing the region’s stories through writing, photography, and guides for those who live here or dream of making the Algarve their home.

As a Level 10 Google Local Guide, Mark has contributed extensively to showcasing the Algarve’s hidden beaches, historic towns, and local gems, helping both residents and visitors discover the best of this southern paradise.

🔗 mark-mcloughlin.com