The Ultimate Guide to Getting a Mortgage in Portugal (2025)

Everything you need to know about mortgage rates, simulators, documents, and expert advice to buy property in Portugal with confidence.

📑 Table of Contents

- Why Buy Property in Portugal?

- Types of Mortgages Available in Portugal

- Mortgage Rates in Portugal (2025)

- Use Our Mortgage Calculator

- Step-by-Step Mortgage Process in Portugal

- Documents Required for a Portuguese Mortgage

- Costs & Fees: The True Price of Financing

- Banking in Portugal: Opening an Account

- Expert Mortgage Broker Advice

- FAQs

- Next Steps & Free Downloads

Why Buy Property in Portugal?

Portugal continues to rank as one of the best places to buy real estate in Europe in 2025. With beautiful beaches, stable property values, excellent healthcare, and welcoming residency options, it attracts both investors and lifestyle buyers.

The Algarve in particular offers:

Excellent rental returns

Sunshine 300+ days a year

English-speaking professionals

A safe, stable investment climate

Types of Mortgages Available in Portugal

Whether you’re a resident or non-resident, Portuguese banks offer a variety of mortgage options:

Acquisition Mortgages

Construction Loans

Equity Release Mortgages

Mortgage Transfers

Capital Repayment Mortgages

Interest-Only Mortgages

Variable and Fixed-Rate Options

💡 Non-residents can generally borrow up to 70% of the property value, while residents may access up to 90%.

Mortgage Rates in Portugal (2025)

Here are the average mortgage rates in Portugal as of Q2 2025:

| Mortgage Type | Rate (Approx.) |

|---|---|

| Fixed 20–30 Years | 3.9%–4.5% |

| Variable Rate | 3.2%–4.0% |

| Interest-Only (short-term) | 4.5%+ |

Rates vary depending on residency status, income, loan term, and LTV ratio. We recommend checking with a broker for tailored options.

Use Our Mortgage Calculator

Try our free Mortgage Calculator for Portugal to estimate your monthly repayments based on:

Property price

Down payment

Mortgage term

Fixed or variable rate

Example: A 400,000€ property with a 30% deposit at 4.1% over 30 years = ~€1,357/month (principal & interest)

- Principle and Interest

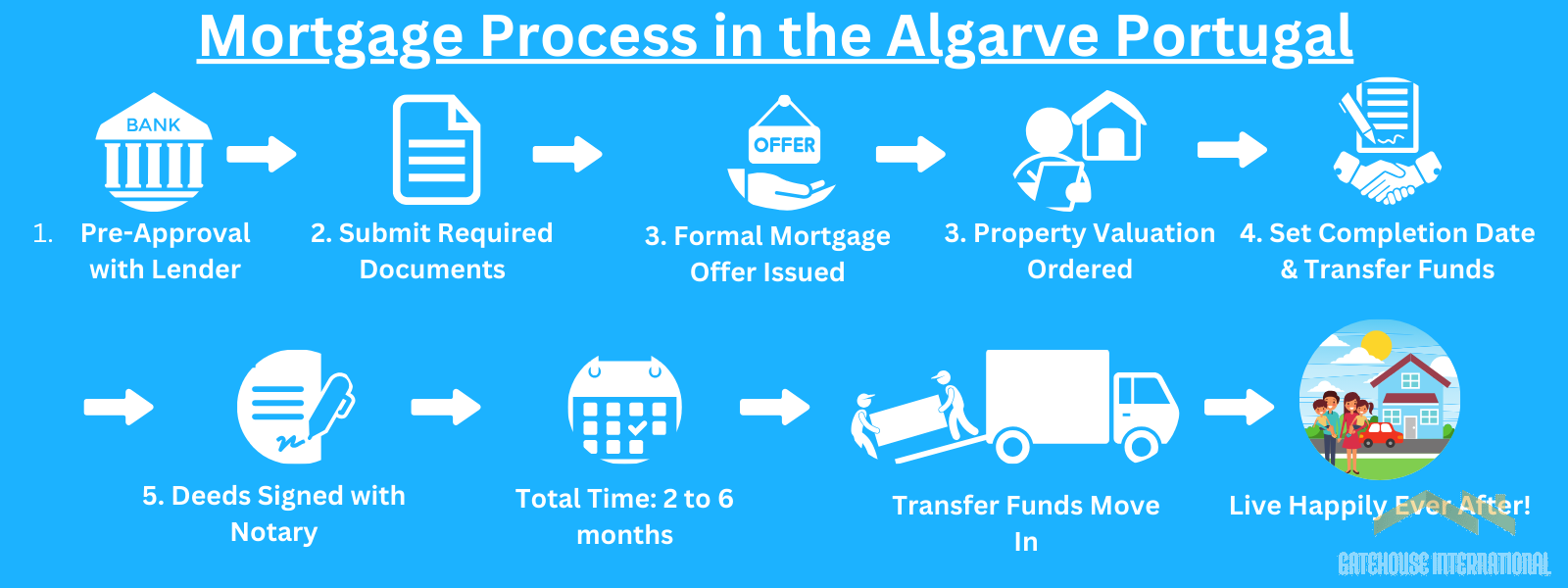

Step-by-Step Mortgage Process in Portugal

Buying with a mortgage? Here’s what to expect:

Pre-Approval with Lender

Gather and Submit Required Documents

Formal Mortgage Offer Issued

Property Valuation Ordered

Set Completion Date & Transfer Funds

Deeds Signed with Notary

⚠️ Total time: 2 to 6 months

Download the full timeline infographic here: Mortgage Timeline PDF

Documents Required for a Portuguese Mortgage

Personal Documents:

Passport(s)

Portuguese Tax Number (NIF)

Proof of income (contracts, tax returns)

3–6 months of bank statements

Utility bill

Property details (if available)

Employment Status:

Employed: payslips, employer letter

Self-Employed: tax returns, P&L accounts

Retired: pension proofs

📥 Download our Mortgage Document Checklist PDF here.

Costs & Fees: The True Price of Financing

💰 Estimated Costs for €250,000 Property:

| Cost Item | Estimated Value |

| IMT Tax | €5,000 |

| Stamp Duty (0.8%) | €2,000 |

| Legal Fees | €1,800 |

| Application & Valuation | €580 |

| Deeds & Registry | €2,400 |

| Total | €11,780 |

Estimate Your Buying Costs in Portugal (2025)

Estimated Costs:

- Deposit: €

- IMT Tax: €

- Stamp Duty (0.8%): €

- Legal Fees (~0.75%): €

- Mortgage Fees: €

- Deeds & Registry: €

- Total Estimated Costs: €

Based on a deposit for your buyer type.

Expert Mortgage Broker Advice

Our partner Independent Mortgage Broker offers:

Multilingual advisors (EN/PT/DE)

Full market access to Portuguese lenders

Independent advice and reports

Tailored mortgage structuring

📞 Want help with your mortgage? Contact us now.

Banking in Portugal: Opening an Account

Before securing a mortgage, you’ll need a Portuguese bank account. Here’s how:

Provide ID and proof of address

Get your NIF number

Choose between retail or digital banks (e.g., Wise, Revolut, N26)

Make sure your bank supports Multibanco

FAQs

What deposit is needed as a non-resident?

Typically, 30% of the property’s value (based on the bank valuation).

How long does the process take?

2–6 months from first contact to completion.

Can I get a mortgage without living in Portugal?

Yes. Non-residents can apply remotely via brokers.

Do I need a Portuguese bank account?

Yes, to process payments and prove financial standing.

Are interest-only mortgages common?

They exist but are less common and usually short-term.

Next Steps & Free Downloads

⚠️ Please note obtaining a preliminary offer from your chosen bank as soon as possible is advisable. This will show you not only the amount you will need but also the repayments. It will also provide some security when making an offer, most agents give preference to cash buyers if you do not have the offer already agreed.

Mark McLoughlin: A Passionate Explorer of Algarve’s Rich Heritage

For over 20 years, Mark has called the Algarve home, immersing himself in its landscapes, culture, and history. His passion lies in sharing the region’s stories through writing, photography, and guides for those who live here or dream of making the Algarve their home.

As a Level 10 Google Local Guide, Mark has contributed extensively to showcasing the Algarve’s hidden beaches, historic towns, and local gems, helping both residents and visitors discover the best of this southern paradise.

🔗 mark-mcloughlin.com